What is Inflation?

Inflation is a rise in the general level of prices of goods and services in an economy over a period of time.

When the general price level rises, each unit of currency buys fewer goods and services. Therefore, inflation also reflects an erosion of purchasing power of money.

According to Crowther, “Inflation is State in which the Value of Money is Falling and the Prices are rising.”

In Economics, the word ‘inflation’ refers to General rise in Prices Measured against a Standard Level of Purchasing Power.

Here are several variations on inflation used popularly to indicate specific meanings.

- Deflation is when the general level of prices is falling. It is the opposite of inflation. Also referred to as Disinflation.The lack of inflation may be an indication that the economy is weakening.

- Hyperinflation is unusually rapid inflation in very short span of time. In extreme cases, this can lead to the breakdown of a nation’s monetary system with complete loss of confidence in the domestic currency. One of the earlier examples of hyperinflation occurred in Germany in early 1920s after the First World War, when prices rose 2,500% in one month.

-

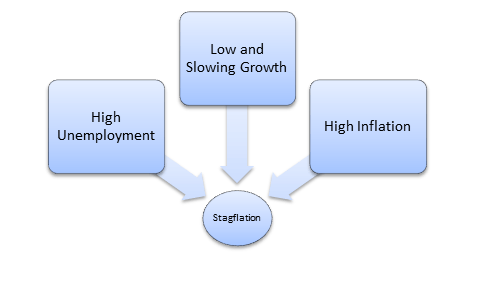

Stagflation is the combination of high unemployment with high inflation. This happened in industrialized countries during the 1970s, when a bad economy was combined with OPEC raising oil prices led to low growth.

Inflation is all about prices going up, but for healthy economy wages should be rising as well. The question shouldn’t be whether inflation is rising, but whether it’s rising at a quicker pace than your wages, if the answer is a Yes only then inflation is problematic.

Finally, inflation is a sign that an economy is growing. The RBI considers the range of 4-5 % as comfort zone of inflation in India.

<<<< Read about Current Affairs of the week here >>>>

Impact or Effect of Inflation :

- Inflation affects the pattern of production, a shift in production pattern takes place from consumer goods to luxury goods.

- On Investment: Inflation discourages entrepreneurs in investing as the risk involved in the future production would be very high with less hope for returns.Uncertainty about the future purchasing power of money discourages investment and savings.

- Inflation also results in black marketing. Sellers may stock up the goods to be sold in the future, anticipating further price rise.

- The effect of inflation is felt on distribution of income and wealth and on production.

- People with fixed income group are the worst sufferers of inflation.Those living off a fixed-income, such as retirees, see a decline in their purchasing power and, consequently, their standard of living.

- The entire economy must absorb repricing costs (“menu costs”) as price lists, labels, menus and more have to be updated.

- If the inflation rate is greater than that of other countries, domestic products become less competitive.

- They add inefficiencies in the market, and make it difficult for companies to budget or plan long-term.

- On Exchange rate and trade: There can also be negative impacts to trade from an increased instability in currency exchange prices caused by unpredictable inflation.

- On Taxes: Higher income tax rates on taxpayers. Government incurrs high fiscal deficit due to decreased value of tax collections.

- On Export and balance of trade: Inflation rate in the economy is higher than rates in other countries; this will increase imports and reduce exports, leading to a deficit in the balance of trade.

Causes of Inflation:

There is no one cause that’s universally agreed upon, but at least two theories are generally accepted while the debate still goes on:

- Demand-Pull Inflation – This theory can be summarized as “too much money chasing too few goods”. It is a mismatch between demand and supply , if demand is growing faster than supply, prices will increase. This usually occurs in growing economies as more people gain purchasing power while the supply is not able to catch up to growing demand.When the government of a country print money in excess, prices increase to keep up with the increase in currency, leading to inflation.

- Cost-Push Inflation – When production costs go up, there is an increase in prices to maintain profit margins. Increased costs can include things such as wages, taxes, or increased costs of imports.

- Demand pull vs Cost Push Inflation• If demand pull inflation is present in the economy, the government must bear the cost of excessive spending and monetary authorities are to be blamed for “cheap money policy”• On the contrary, if cost push is the real cause for inflation then the trade union are to blamed for excessive wage claim, industries for acceding them and business firms for marking- up profits aggressively.

<<< Read about Volcanoes here >>>

Measurement of Inflation

Inflation is measured by calculating the percentage rate of change of a price index, which is called the inflation rate.

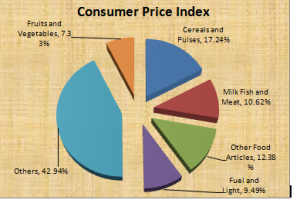

Inflation is often measured either in terms of Wholesale Price Index or in terms of Consumer Price Index.

-

Wholesale Price Index(WPI) : The Wholesale Price Index is an indicator designed to measure the changes in the price levels of commodities that flow into the wholesale trade intermediaries.The index is a vital guide in economic analysis and p

olicy formulation. It is a basis for price adjustments in business contracts and projects. It is also intended to serve as an additional source of information for comparisons on the international front.

olicy formulation. It is a basis for price adjustments in business contracts and projects. It is also intended to serve as an additional source of information for comparisons on the international front. - Consumer Price Index (CPI) : Consumer price index is specific to particular group in the population. It shows the cost of living of the group. It is based on the changes in the retail prices of goods or services. Based on their incomes, consumer spends money on these particular set of goods and services. There are different consumer price indices. Each index tracks the changes in the retail prices for different set of consumers.

More on the Price indexes in India, click here.

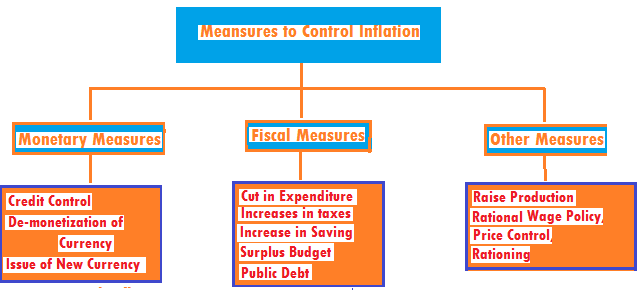

Measures to control inflation:

Effective policies to control inflation need to focus on the underlying causes of inflation in the economy.There are two broad ways in which governments try to control inflation. These are-

1. Fiscal measures. 2. Monetary measures

- Monetary Policy: Monetary policy can control the growth of demand through an increase in interest rates and a contraction in the real money supply. For example, in the late 1980s, interest rates went up to 15% because of the excessive growth in the economy and contributed to the recession of the early 1990s.

- Monetary measures of controlling the inflation can be either quantitative or qualitative. Bank rate policy, open market operations and variable reserve ratio are the quantitative measures of credit control, by which inflation can be brought down. Qualitative control measures involve selective credit control measures.

- Bank rate policy is used as the main instrument of monetary control during theperiod of inflation. When the central bank raises the bank rate, it is said to haveadopted a dear money policy. The increase in bank rate increases the cost ofborrowing which reduces commercial banks borrowing from the central bank.Consequently, the flow of money from the commercial banks to the public getsreduced. Therefore, inflation is controlled to the extent it is caused by the bankcredit.

- Cash Reserve Ratio (CRR) : To control inflation, the central bank raises the CRR which reduces the lending capacity of the commercial banks. Consequently,flow of money from commercial banks to public decreases. In the process, ithalts the rise in prices to the extent it is caused by banks credits to the public.

- Open Market Operations: Open market operations refer to sale and purchaseof government securities and bonds by the central bank. To control inflation,central bank sells the government securities to the public through the banks.This results in transfer of a part of bank deposits to central bank account andreduces credit creation capacity of the commercial banks.

Lets look into fiscal policy now.

- Fiscal Policy:

- Higher direct taxes (causing a fall in disposable income).

- Lower Government spending.

- A reduction in the amount the government sector borrows each year .

- Direct wage controls – incomes policies Incomes policies (or direct wage controls) set limits on the rate of growth of wages and have the potential to reduce cost inflation.

- Government can curb it’s expenditure to bring the inflation in control.

- The government can also take some protectionist measures (such as banning the export of essential items such as pulses, cereals and oils to support the domestic consumption, encourage imports by lowering duties on import items etc.).

that was so helpful for me according to my needs … can u write about commercial bank and their function , central bank and their functions . i am searching on other places ,but still not found what i need…….