We know that a cheque is negotiable instrument. Any informed individual will be aware that during the process of circulation, a cheque might get stolen, lost or may even have forged signature of payee. This type of situation may result in wrong use of the cheque.

Therefore, crossing of the cheques is a popular device for protecting the drawer and the payee. The bearer and order cheques both can be crossed. Hence, crossing of cheques prevents fraud and wrong payments

Definition of Crossed Check/ Cheque

Crossing of Cheque

Any cheque can be crossed by crossed with two parallel lines. Crossing means drawing of two parallel transverselines across the cheque with or without the words in between those lines.

The crossing of cheque gives a direction to the drawee bank to not pay the mentioned amount at the counter, instead the payment should be done through a bank. This guards payment against forgery by any unscrupulous persons because a crossed cheque can only be deposited directly into a bank account and cannot be cashed immediately.

Importance of Crossing of Cheque:

The significance of crossing of a cheque is that a crossed cheque cannot be encashed by the bearer but can only be collected from the drawee bank in the bank account. (Sec. 123 and 126 of the Negotiable Instruments Act) Therefore, Crossing of cheque provides protection and safeguard to the issuer of the cheque. In case of a crossed cheque one can easily detect who encashed the said cheque, unlike the case of non-crossed cheque. Hence, Crossing protects both payer and the payee of the cheque. Also, both bearer and order cheques can be crossed.

Rules of Crossing of Cheque

Negotiable Cheques are generally crossed as a measure of safety.

- A cheque can be crossed generally, may be crossed specially by the holder.

- The Cheque holder has the right to add the words “not negotiable” to it.

- When an uncrossed cheque or a crossed cheque generally is sent to a banker for the collection, the person may cross it specially to himself. In this case, he does not enjoy the Statutory protection against being sued for conversion.

Types of Cheque Crossing:

There are two types of crossing of cheques – General and Special crossing of cheques.

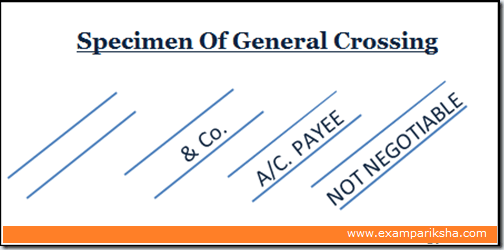

General Crossing of Cheque

Section 123 of the Negotiable Instruments Act has defined General Crossing – “where a cheque bears across its face an addition of the words ‘And Company’ or any abbreviation thereof, between two parallel transverse lines or of two parallel transverse lines simply, and either with or without the words ‘not negotiable’, that addition shall be deemed to be a crossing of cheque and the cheque shall be deemed to be crossed generally”.

General Crossing involves two parallel transverse lines across the face of the cheque with or without ‘not negotiable’ written on it. Such addition shall be considered to be a crossing.

To summaries, A cheque is considered to be generally crossed in the following cases:

- When there are two transverse parallel lines marked across the face of cheque

- When the cheque bears an abbreviation “& Co.” between the two transverse parallel lines

- When the cheque bears the words “Not Negotiable” written between the two parallel lines

- When the cheque bears the words “A/c. Payee” between the two transverse parallel lines.

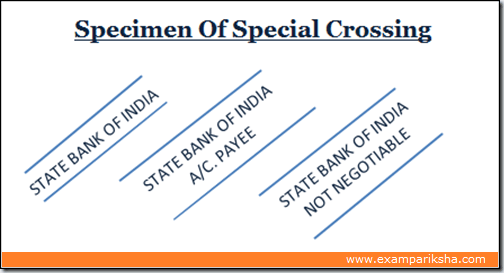

Special And Restrictive Crossing of Cheque

A cheque is said to be specially crossed when a particular bank’s name is written in between the two transverse parallel lines on the cheque.

According to the Section 124 of the Negotiable Instruments Act, Special Crossing is defined as, the cheque which “bears across its face an addition of the name of a banker, with or without the words “not negotiable”, that addition shall be deemed a crossing and the cheque shall be deemed to be crossed specially and to be crossed to that banker”.

In a special crossed cheque, the amount written in cheque is payable by the drawee only, and only to the bank named in the crossing.

Not negotiable Crossing of Cheque

The effect of writting ‘not negotiable’ crossing of cheque is that the cheque can be transferred but transferee will not be able to acquire a better title to the cheque. Thus, such a cheque is deprived of its essential feature of negotiability. The payment of such a cheque is not made unless the bank named in the crossing of cheque is presenting the cheque.