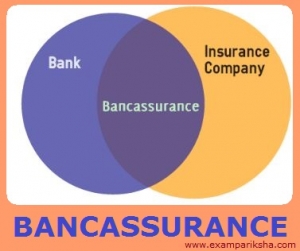

Bancassurance refers to selling of insurance policies through banks. Banks earn revenue through this sale of insurance policies. The concept of bancassurance originated in France. In India, this process began in the year 2000. Traditionally, insurance products were sold only through individual agents and they solely accounted for a major chunk of business in retail segment.

The Insurance Regulatory and Development Authority (IRDA) came up with regulation on registration of Indian insurance companies. Government of India issued a notification specifying ‘Insurance’ as a permissible form of business which could be undertaken by banks under the Section 6(1)(o) of the Banking Regulation Act, 1949. However, it was also clarified that any bank intending to take up the business would have to seek specific approval from the RBI. All scheduled commercial banks have been permitted to undertake the insurance business as the agent of insurance companies on fee-basis, without any risk participation. Also, specific rules were framed for set up of joint venture companies for undertaking the insurance business with risk participation.

Since then, there has been no looking back ever since. With the opening up of this sector to private players, competition in this sector has become more intense. Insurance industry in India has been progressing at a rapid pace since the opening up of the sector to the private companies in 2000.

Bancassurance in India

In India the banking and the insurance sectors are regulated by two different entities. While the banking sector is governed by Reserve Bank of India, the insurance sector is regulated by the Insurance Regulatory and Development Authority (IRDA). Since Bancassurance, is the combination of these two sectors, it comes under the purview of both the RBI and IRDA regulations.

<<Read about RBI, role and functions here>>

<<Read about IRDA in brief here>>

Corporate Agency Regulations:

Banks can act as corporate agents for only one life insurance company and one non life insurance company in lieu of a commission, according to current regulatory framework set up by the IRDA. Under this, the banks are not eligible for any payout other than the said commission. It is also mandatory for banks to observe code of conduct prescribed towards both customer and the principal who is the insurer.

Broker Route: Banks cannot become brokers, since the IRDA regulations require brokers to be exclusively engaged in insurance broking business. Also, RBI does not allow banks to promote separate insurance brokerage outfits.

Advantages of Bancassurance to Banks and Insurance Companies

- The insurance company will attract further business, both from existing and the new policyholders, because it can offer a wider range of services than what they could before.

- It gives the customers access to banking as well as insurance services. It also encourages customers of banks to purchase insurance policies and further promotes a better relationship with the bank.

- The economics of the Bancassurance operation allows the insurer to offer products which were not feasible through the insurer’s existing channels previously. For example, if the sales cost incurred under the existing channels force premium rates for a said product to render it uncompetitive, the product will not be sold. On contrary, the costs via the Bancassurance channel may be low enough to make such products feasible.

- The insurance company may offer to carry out the administrative activities of the bancassurer’s business, if for instance, the bancassurer is a separate company. Upon, combining the bancassurer’s business with that of the insurer, they can produce economies of scale in the administration costs including the capital expenditure.

- Combining of the business administration allows the insurer to improve profitability and also enables them to price their future products with narrower margins. It helps to make the insurer’s products more competitive in the market.

- Both for the bank and the insurer there lies a great opportunity to learn and to make improvements in their own operations. Since, each one gets exposure to the other’s distinctive management styles, objectives, measures and the pressures. The benefit comes to either company which can implement the innovations as a result of the learning process.

Benefits of Bancassurance to Customers

- Bancassurance encourages customers of banks to purchase the insurance policies associated and further helps in building a better relationship with the bank.

- The people/customers who are unaware of or are not in the reach of insurance policies would benefit through the widely distributed banking networks and better marketing channels available to the banks.

- An increase in number of insurance providers means an increase in the competition and hence, people can expect better premium rates and also better services from bancassurance when compared to the traditional insurance companies.

Demerits/ Disadvantages of Bancassurance

- The data management of an individual customer’s identity and the contact details might result in the insurance company utilizing the details to market their products, but this may compromise on data security.

- In case of conflict of interest between the other products of bank and the insurance policies (such as money back policies), the customers may get confused regarding where to invest.

- It should be noted that, better approach and services will be provided by the banks to customer, is a hope rather than a fact. This is unlikely because many banks in India give bad customer service and this will turn worse when they are also responsible to sell insurance products.

Important bancassurance tie-ups in India

- LIC: The insurance company LIC of India have tie up with the following bank for Bancassurance. They are:

- Corporation Bank

- Indian Overseas Bank

- Centurion Bank

- Sahara District Central Co-operative bank

- Janta Urban Co-operative bank

- Yeotmal Mahila Sahakari Bank

- Vijaya Bank

- Oriental Bank of Commerce

- SBI Life Insurance Co: The SBI life Insurance Co Ltd is running its Insurance business with the help of S.B.I.

- Bajaj Allianz General Insurance Co. Ltd: It has tie-up with Karur Vysya Bank & Lord Krishna Bank.

- Birla Sun life Insurance Co. Ltd: The Birla Sun life Insurance Company has a tie-up for bancassurance with the following banks: (a) Bank of Rajasthan (b) Andhra Bank (c) Bank of Muscat (d) Development Credit Bank (e) Dutch Bank & (f) Catholic Syrian Bank.

There are many more like ICICI Prudential, United India Insurance Co -Ltd. & so on.